-1.jpg)

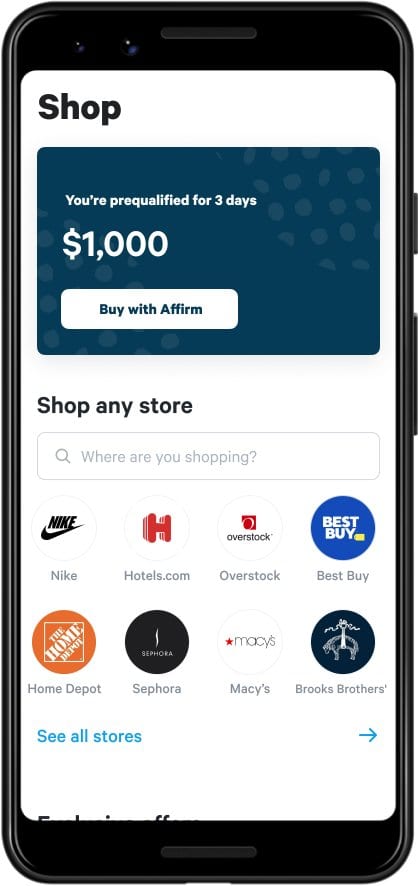

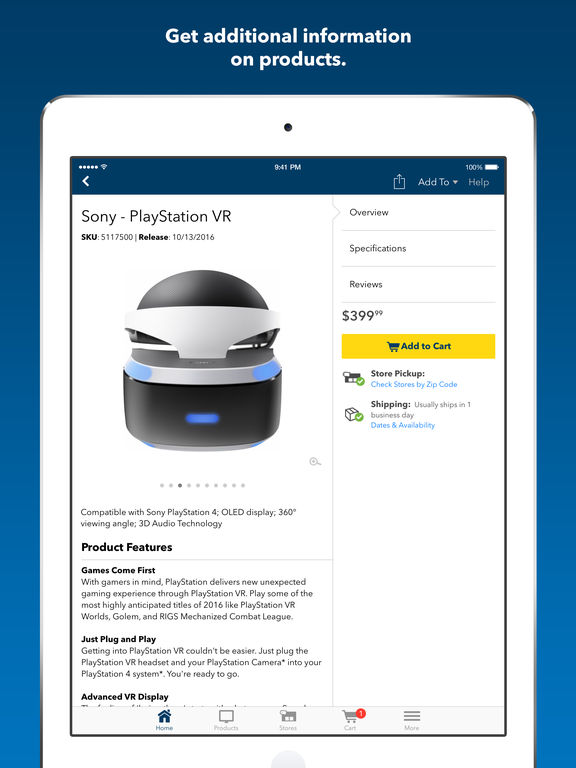

Popular retailers that use Zip are Best Buy, Newegg, and FashionNova. Zip is capable of integration with its mobile app anywhere Visa is accepted, leading to widespread availability. Lower purchasing limits for first-time shoppersįormerly known as QuadPay, Zip is another provider that uses the traditional Pay-in-4 method.Payment plans: Pay-in-4, spread over 6 weeks.

Merchant Fees: averages 5.99% + $0.30 per transaction–varies by business type and size.Interest Rates: 0% on pay-in-four 0%-30% for monthly payments.Integrating Klarna with your checkout system provides customers with three alternative ways to pay which is the highest out of our list. Klarna’s best feature for merchants is its flexible ways to pay. Klarna also allows users to collect rewards to be redeemed on future purchases. Their star feature, the Klarna Card, allows customers to turn any purchase at any retailer that accepts VISA into a BNPL transaction. Founded in 2005, Klarna pioneered the Pay-in-4 model that can now be used online and in-store. Klarna is used by major retailers like H&M, Sephora, Adidas, and Petco. Klarna is a Swedish BNPL service with a consumer base of 147 million consumers, 450,000 retail partners, and available in 17 countries. We have done some conversion rate testing on BNPL apps for our clients and did not see the same results stated below, but they did have positive results. Note: The data from each of these companies is from their website. So what is the best Buy Now, Pay Later platform for eCommerce businesses? We compared six of the most popular BNPL providers for merchants. This payment model allows them to have the things they want now while drawing out payments over time. BNPL also provides the instant gratification that is sought after by younger millennials and gen-z consumers. With c redit card interest rates on the rise, shoppers are looking for alternative ways to pay, and BNPL models are an increasingly attractive option for those looking for credit given that many BNPL providers do not charge interest or late fees. If customers can expect a hassle-free checkout process, they’re more likely to return in the future. Create greater customer loyalty by offering flexible payment options.Shoppers are more likely to complete a larger purchase if they’re able to split up the payments over time. Increase checkout conversions by +35%.Millennials and Gen-zers in particular are more likely to gravitate toward BNPL options for online purchases. Increase your audience by offering a variety of payment methods.Regardless of whether or not the customer completes their installment plans, you as a business receive the payment from the BNPL This allows merchants to focus on other aspects without worrying about chasing customers for payments. Merchants receive the payment upfront, with the BNPL companies footing the small loan and handling financing.Although BNPL is popular for luxury goods, businesses that sell lower-priced goods will also see an increase in cart sizes when customers learn they can make smaller payments. Increase average order value (AOV) by +45%, depending on the BNPL option chosen.So why partner with a BNPL company? For merchants: As a merchant, providing your customers with multiple avenues for purchases gives them a sense of ease and flexibility. According to a survey done by Klarna of 2,000 consumers and 250 retailers, 36% of consumers say flexible payment options would encourage them to shop again with a brand and 27% said flexible payment options would make them more likely to spend more with a brand. A complicated or rigid checkout experience is one of the last sales obstacles stopping customers from completing their purchases. A seamless and smooth checkout process is critical for any eCommerce business.

0 kommentar(er)

0 kommentar(er)